- Areas of Interest:

- Governmental finance, especially questions of policy and administration of sales and property taxation

- State lotteries

- Public budgeting

- Public finance in countries of the former Soviet Union

Education

- Ph.D. in economics, University of Illinois - Urbana, 1969

- MA in economics, University of Illinois - Urbana, 1965

- B.A. in economics (cum laude), Wabash College, 1964

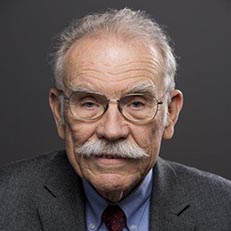

Biography

With profound sadness, we report that John Mikesell passed away on September 12, 2019.

John L. Mikesell was an expert in governmental finance, specializing in sales and property tax policy and administration and public budgeting systems. He wrote Fiscal Administration, Analysis and Applications for the Public Sector, the standard public finance and budgeting textbook in graduate public affairs program, now in its tenth edition. Mikesell's work on government finance and taxation has appeared in journals such as Public Budgeting & Finance, Public Finance Quarterly, National Tax Journal, Public Administration Review, and Journal of Public Budgeting, Accounting, and Financial Management.

Mikesell had extensive international experience as a financial consultant and fiscal economist. He has worked with World Bank public budget system reform missions in the Kyrgyz Republic, Turkmenistan, Kazakhstan, and Azerbaijan. He also worked on USAID intergovernmental fiscal restructuring projects in Ukraine and the Russian Federation, and assisted the People's Republic of China in developing a property tax. Since the 1970s, Mikesell has served on the Revenue Forecast Technical Committee as it produced the Indiana revenue forecast for the state budget. He worked on state tax revision studies in Indiana, Minnesota, New York, and Hawaii.

Mikesell received the Wildavsky Award for Lifetime Scholarly Achievement in Public Budgeting and Finance from the Association for Budgeting and Financial Management, the Steven D. Gold Award from the National Tax Association, the Association for Public Policy Analysis and Management, and the National Conference of State Legislatures for Outstanding Contributions to State and Local Fiscal Policy, and the Tax Foundation Award for Achievement in State Tax Reform.

Highlights

- Editor-in-chief of Public Budgeting & Finance (1996-2011)

- Editorial board member of Public Budgeting & Finance, Public Finance and Management, Journal of Public Budgeting, Accounting, and Financial Management, and Business Systems and Economics (Vilnius)

- Chief of party and chief economist, Barents Group U.S. AID Fiscal Reform Project in Ukraine (1995) and resident director of intergovernmental fiscal reform program, Georgia State University U.S. Aid Fiscal Reform Project in Russian Federation (1998-1999)

Selected Works

- Fiscal Administration, Analysis and Applications for the Public Sector. Tenth edition. Stamford, CT: Cengage Learning (2018)

- “Retail Sales Tax in 2017: Modest Growth in a Vital Revenue Source,”State Tax Notes 89 (2018)

- “Corruption and State and Local Government Debt Expansion,” (with C. Liu and T.T. Moldogaziev), Public Administration Review, (January 2017)

- “State revenue forecasting and political acceptance: The value of consensus forecasting in the budget process,” (with J. Ross), Public Administration Review, 74 (4) (2014)

- “Misconceptions about value added and retail sales taxes: Are they barriers to sensible tax policy?”Public Budgeting & Finance, 34(2) (2014)

- “Fast money? The contribution of state tax amnesties to public revenue systems,” (with J. Ross), National Tax Journal, 65(3): 529-562 (2012)

- “Revenue estimation/scoring by states: An overview of experience and current practices with particular attention to dynamic methods,”Public Budgeting & Finance, 32: 1-24 (2012)

- “State tax policy and state sales taxes: What tax expenditure budgets tell us about sales taxes,”American Review of Public Administration, 42(2): 131-151 (2012)

- “Reforms for improved efficiency in public budgeting and finance: Improvements, disappointments, and work in progress,” (with D. Mullins), Public Budgeting & Finance, 31 (2011)