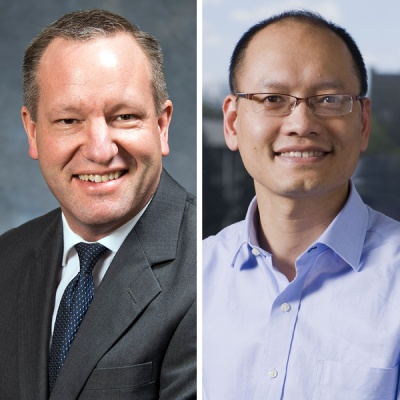

BLOOMINGTON, Ind. – A pair of researchers from the Paul H. O’Neill School of Public and Environmental Affairs have been awarded the 2024 Richard A. Musgrave Prize for the best article published by the National Tax Journal.

Professors Brad Heim and Anh Tran, along with colleagues from the University of South Carolina and the U.S. Department of the Treasury, were recognized for their article “Seeking Professional Help: How Paid Preparers Decrease Tax Compliance.” The piece showed that professional tax preparers are costing the United States government tens of billions of dollars annually due to noncompliance.

“I am very humbled and honored to receive this Award, together with Brad and our coauthors Alex Yuskavage and Jason Debacker,” Tran said. “The National Tax Journal is a rigorously academic journal, but it is also one of the most widely read by tax professionals and policymakers, and therefore has a significant real-world impact. With this Award, we feel fortunate that our study can reach policymakers and provide an analysis with implications for government tax revenue at the scale of billions of dollars.”

The Richard A. Musgrave Prize was created in 1999 and is a tribute to Richard Musgrave, whose work throughout his luminous career was characterized by a powerful blend of analytical clarity, insight drawn from the historical record, and respect for the importance of administrative issues. Data from the study came from roughly 135,000 audits conducted by the U.S. Internal Revenue Service from 2006-14, showcasing the importance of records being made available to researchers.

“We are very fortunate that the U.S. Department of the Treasury has such amazing data available for research and has a system that allows for partnerships between academics and Treasury economists,” Heim said. “I’ve been affiliated with the National Tax Association for more than two decades, and the National Tax Journal is widely read among tax researchers and practitioners. To be recognized by one’s peers to have been a part of the best paper published in the journal during the past year is a great honor.”