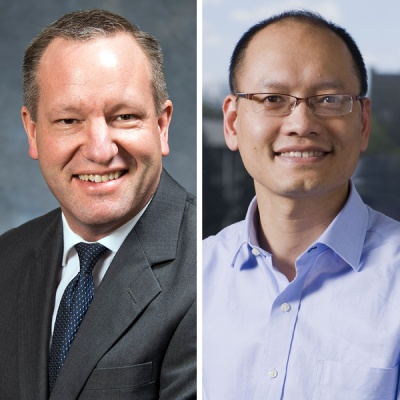

BLOOMINGTON, Ind. – Professional tax preparers bill themselves as the best possible option for taxpayers who want to both comply with the law while also maximizing their benefits. But a new study co-authored by Professors Brad Heim and Anh Tran at the Paul H. O’Neill School of Public and Environmental Affairs shows that professional tax preparers are costing the United States government tens of billions of dollars annually due to noncompliance.

The study, “Seeking Professional Help: How Paid Preparers Decrease Tax Compliance,” published in the June issue of the National Tax Journal, looked at roughly 135,000 audits conducted by the United States Internal Revenue Service from 2006-14. It found paid tax preparers increase their clients’ tax underreporting by 87 percent compared to taxpayers who prepare their own returns or low-income taxpayers who take advantage of volunteer services.

“Despite the fact that the use of preparers is widespread—roughly 60 percent of taxpayers use them, and it’s a $10 billion industry—tax scholars really haven’t settled on what the impact of using a preparer is on tax compliance,” Heim said. “So, we thought we could help answer that question using some better and more recent data than had been used elsewhere.”

The report found that paid tax preparers help clients evade roughly $518 per tax return compared with those who prepare their own return and volunteer third-party preparers. Furthermore, the income bracket and gender of the client impacts the return, as well, with the aggressiveness of tax preparers’ reporting increasing when working for clients who are male and have higher income.

The study also showed that underreporting of Schedule C income, which is income from sole proprietorships, and overclaiming of the Earned Income Tax Credit accounted for almost the entire difference in total audit adjustments. Perhaps not coincidentally, those income sources and deduction items feature little third-party verification available to the IRS.

“There’s a debate in the literature and the tax community on the role tax preparers play,” Heim said. “One camp sees them as helping taxpayers to comply with the tax code. Another camp sees them as hired guns that help people cheat on their taxes. We find evidence for the latter.”